Payment Cards

Payment cards provide a comfortable and secure method for playing for goods and services without the need to constantly carry cash. They offer a great range of payment options as payment cards are now accepted by a majority of hotels, restaurants, transportation companies, travel agencies, healthcare facilities, online shops and other retailers. Payment cards can also be used for withdrawing cash from ATMs and from supermarket checkouts (CashBack).

Fio banka issued payment cards for accounts in CZK and EUR.

Cash withdrawals

With Visa payment cards, you have unlimited withdrawals from all ATMs around the world for free.

The following scheme applies to Mastercard cards:

- All withdrawals from Fio banka ATMs are free

- Every month you have at least 2 free withdrawals from foreign ATMs for free. You can get up to 5 free withdrawals from other ATMs thanks to card payments. Find out how.

Withdraw cash in supermarket - Cashback service allows you to ask for cash when paying in store above 1 CZK (exact rules are determined by the merchant) at the same cash desk. Maximal amount is 3 000 CZK.

You can use cashback in e.g. stores Albert, COOP, Globus, Penny Market, Žabka and others. In addition, you can withdraw cash at our branches free of charge, withdrawals of 1,000 CZK and above are free of charge.

Card blocation - Payment card blocking

Nonstop number for announcing the loss or theft of a card: +420 224 346 777

You can also block your card in the Internetbanking or Smartbanking.

Please note: If you plan to travel abroad, where you will use your payment card, please inform us via Fio service or at any of our branches about the date of travel and the destination in which you will be located, in order to avoid any possible blocking of the payment card.

Security

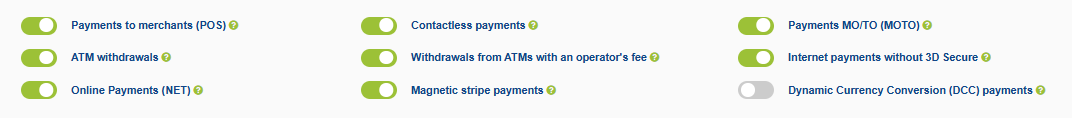

You can block selected types of transactions in your Smartbanking and Internetbanking, for example those with a disadvantageous exchange rate (DCC), ATM withdrawals with an additional operator fee, or Internet transactions without additional 3D Secure verification.

In the payment card settings, you can also block individual types of transactions such as ATM withdrawals in general, payments at terminals, internet transactions, payments from specific countries or at a specific merchant, etc.

How non-contact payment works

With the card, small amounts (up to 500 CZK) can be paid quickly and conveniently without the need to insert the card into the terminal, enter a PIN or sign the bill. For higher amounts, a PIN is required, or it is required to use the card in the traditional contact manner (by inserting it into the chip reader at the merchant's terminal).

- First of all, it is necessary to find out whether the merchant is equipped with a device enabling contactless payments. Non-contact payment can take place at all domestic and international retailers who display a symbol for non-contact payment cards:

- Your card must be placed close to the sensor, which is marked with a non-contact payment symbol. Information on the card is read after an acoustic signal sounds, and some sensors indicate that payment has been approved.

- The retailer will then provide you with a receipt.

Paying by card on the Internet - two-factor authentication (e-PIN vs. Smartbanking)

Card payments on the Internet are protected by two-factor authentication, which differs depending on whether you use our mobile app to verify payments or not. When paying by card in the e-shop, you can simply verify payments in Smartbanking or by combining 3D Secure verification (by SMS code) and e-PIN.

I don't have the Smartbanking mobile app yet, I'm now verifying card payments on the Internet using a code from an SMS, but I want to pay easily

- If you don't want to copy the code from the SMS and remember the e-PIN, download our Smartbanking application, in which you can conveniently and easily authorize card payments on the Internet with a few clicks. You can set up the application for authorization of card payments on the Internet directly in the menu: More - Settings - Authorization of payments - Payments on the Internet (3D Secure) or in Internetbanking on the payment card details.

I do not have the Smartbanking mobile application, I verify card payments on the Internet using a code from an SMS and I want to stay with this method

- From the turn of 2020/2021, another method of verification was added to the existing verification using an SMS code (1st factor). This method is called e-PIN and it is a unique three-digit number that every payment card has. You can find it on the card details in Internet banking or mobile application. This code is the same throughout the card's validity. When paying with a card on the Internet, you will enter it as a second verification after writing down the code from the SMS. So, remember it well.

I have the Smartbanking mobile application and I verify card payments on the Internet in it

- You can already authorize card payments on the Internet by logging into the application and thus meet all security requirements. Thanks to this method of authorization, there is no need to remember another data in the form of an e-PIN, you confirm transactions in the same way (biometrics, PIN) as all other actions in the application. Authorizing payments in Smartbanking is quick and easy, and we definitely recommend this method.

Payment by card in the shop at the terminal

For some merchants, it is possible that they will not yet have the new software implemented in the payment terminals in connection with the European PSD2 directive, and thus the contactless transaction may be rejected. In that case, there is a very simple solution. Simply insert the card into the terminal and confirm with a PIN.

3D Secure

Our payment cards support the 3D-Secure service, which provides improved security for card payments on the Internet. If you pay by card in an e-shop, which support this service, you will need to verify the transaction by an authorization code, which you will receive as an SMS message. Simply activate the service in the Internetbanking by setting up the telephone number (on the card detail screen) to which we will send you an authorization code. The 3D Secure service is free of charge. More information.

Select from our range of payment cards

- Mastercard Debit

International contactless payment card - Visa Classic

International contactless payment card - Mastercard Business

International contactless payment card for business - Visa Business

International contactless payment card for business - Mastercard Gold

International contactless payment card for VIP usage - Visa Gold

International contactless payment card for VIP usage - Visa Business Gold

International contactless payment card for business VIP usage - Visa Platinum

International contactless payment card for VIP usage

Additional services

- Insurance to our payment cards

Choose from travel insurance, card fraud insurance or legal costs insurance coverage.

- Payment by mobile phone or watch